Let’s start by stating the obvious: during the last 3 months, Customer behaviors have drastically changed. While each market is different unique, there are some common traits: shopping frequency has decreased, basket value has increased, and the components of the basket has shifted towards more essential products.For retailers, it means that the ranges and assortment they previously had do not deliver the same results today. Some items sell much less, some items selling more than before don’t have enough shelf-space, inventories grow and, margin decrease.Our client was also facing such trends. And they reacted quickly, taking the risk of disrupting stores during a short period to rebuild a more adapted and more profitable offer to their Customers. They decided to “Rationalise” the assortment of all their stores and formats.

1. What shall Rationalization deliver?

An assortment rationalization can deliver many things. So before starting, we had several working sessions with the Client to precisely scope what were the outcome.

In our case, it was a decrease in the number of SKUs to:

- Increase sales per sqm.

- Provide more space for Top items and ease supply chain

- Reduce unnecessary inventories

- Guarantee 100 % Distribution for top items across their 90 stores

2. What should be rationalized

Once the Project Objectives were final, the second round of questions was focusing on whether we should focus on strategic categories or englobe the complete store. There are pros and cons to each scenario.

In our case, the decision was to review the all store. Yes, there was a risk of potentially having to review the space allocation afterward, but we agree with our Client that it was an excellent opportunity to establish a solid basis for further improvements.

In other cases, other rationalization objectives could also have been set up, For example:

- Free up running feet

- Reduce inventory

- Reduce the number of Brands

- Reduce the number of Price Points

- Align the Good-Better-Best price structure with a guideline

- ,,,

3. Define the Business Rules

Before starting with the work, itself, we hold it a bit longer to establish with the Client what should be the business rules the rationalization should follow.

The objectives of the Business Rules go beyond the rationalization: they would also impact how Buyers and Category managers would manage the assortment after the rationalization. Some of the critical rules that were decided are, for example:

- Assortment is stacked

- 100% of the assortment is mandatory (even if some items are mandatory only in 1 store: supply chain and store teams are thus eased)

- The space allocated by Product Type

- The maximum number of items by Bay

- What should be the metrics to define whether an item should be kept or deleted

- What should be the Merchandise Hierarchy level to which the item selection metrics should be applied to

- Items belonging to the Housewife basket (from the Client CRM data) should not be removed

- Items belonging to Big Spender (from the Client CRM data) should be highlighted

4. Consolidate & Organize Data

It was now time to work with the data. Thanks to the Cleary defined project objectives and the translation of the business rules in metrics, it was easier to identify which data to extract.

To save time, we organized the data to the selected level of the Merchandise hierarchy where the item selection metrics would apply.

In addition to the development of the supporting formulas, we also ensured to build in filters to guarantee that:

- When one item was selected in a smaller store size it was also present larger store size

- Selected items had a 100% distribution

- Every time an item was selected it was accepted by the bay

5. Review & Repeat

After having pressed the “Run” Button, following the programmed business rules, the program delivered its suggestions of items to keep and items to deleted (at sub-category level in the case of our client).

A thorough reviews of the formulas, business rules (with a specific focus on strategy items belonging to the Housewife Baskets and Big Spender Baskets) as well as the use of common merchant sense (if there is only 1 item left in a sub-category whose sales are minimal, should we keep the category?), we were ready to send the Assortment proposal to the Client

6. Client Final Choice & Execution

When we sent the working file to our Client, we ensured that we built in a validation function that informed when the Category Managers final choices were over the maximum number of items per bay.

In that way, the Client’s Teams were totally independent in their choice with clear visibility of what their decisions would entail.

To Maintain Continuous Improvements

The one-shot exercise was necessary, and it was successful only because of the wonderful execution done by the Operation Teams.

Such a complete exercise can not be repeated too often, and still, assortment rationalization needs to be performed regularly as Customers Shopping Behaviors keep on changing.

So, we set up a simple monthly schedule, articulating what we called Super Core Categories (that represent more than 50% of the sales) and Core Categories.

And for each category, the work is done across all formats and store size: not only can the Category Manager have a consistent vision and tactics across formats, but suppliers can also follow and achieve the same level of consistency for their Brands’ ranges.

As the tool is built, 80% of the work will be automated.

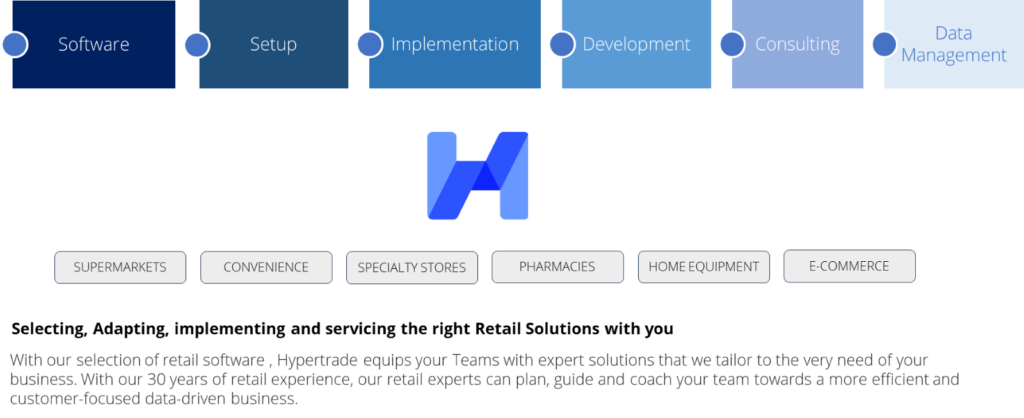

We marry retail expertise with people, processes, and data to support Leaders and their Teams in their Optimization Journey, working on the 4 Components of their Retail Operations